How Do You Increase Sales During The Slow Months Of The Year?

Nothing is more painful than the end of a bad quarter you knew was coming. Slow months can just be natural in some businesses, but that doesn’t mean you can’t succeed when the sales start to lull.

We created a case study where we studied how our clients performed over their traditional slow months. We wanted to see two things:

- Which of our digital marketing tactics have historically been the most effective across industries and business size.

- How often did those client beat the industry average using those marketing strategies

What we learned is that for each case, there’s always one marketing channel that outperforms the others.

Overview

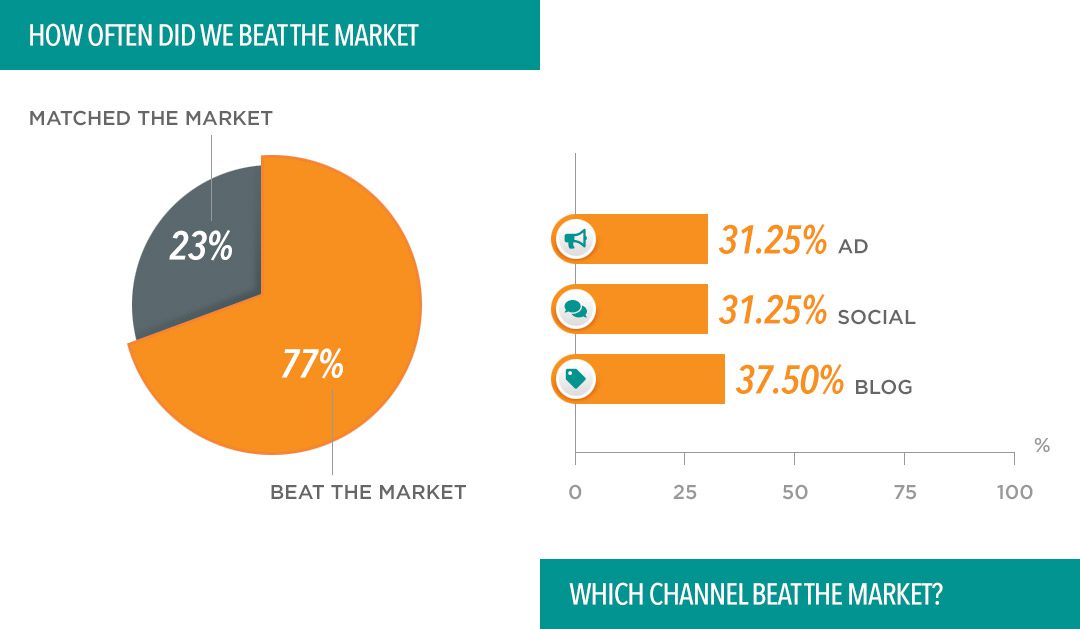

We found that 77% of the time, our long-term clients received an increase in conversions during the slow months where statistically, their industry does the worst. We measured this over four main categories:

- The Medical Industry

- The Real Estate Industry

- The Retail / Ecommerce Industry

- The B2B Service Industry

We went back over the past two years of work to see which strategies have been the most effective for coming out victorious when our client’s competitors often fail.

Here’s what we found.

Chatter Buzz Created a Case Study About Industry-Driven Slow Months

Digital Marketing mostly comes from two things: changes in marketing strategy and getting the right data. As marketers, our strategies are based on data. If we can see what’s happened, we can respond with a good strategy to make it better.

Digital Marketing doesn’t often benefit from the long-term case studies we see in traditional media marketing. Often, the marketing channels, platforms, and tools are tweaked and changed too often for it to be of use.

However over the past decade, three tools have become the center-point of most strategies:

- Digital Advertising

- Social Media

- SEO

We wanted to see which was most important to use during slow season.

Why did we make the study?

These slow months can create noise in your data. For data analysts and data scientists, this noise essentially clouds your data making it difficult to get an accurate idea of what’s working and what’s not.

We decided we wanted to get an idea of the impact of our client’s slow months and what caused them. We wanted to see if it was caused by inadequate response to the campaign, or due to an industry-wide drop in that month’s performance.

What we found was that not only did we do well during slow months, but most of our slow months were a reduction in growth; we didn’t have a stagnate month with our clients, with a few exceptions.

What are the metrics used?

We measured two key features: the conversion rate and the number of conversions. The total number of conversions gives us an idea of how many leads the client received. This, of course, is the metric you want to increase the most.

No leads mean no sales, and no sales mean no business.

The conversion rate, on the other hand, tends to get overused as a metric but is perfect in this case. We wanted to see based on the number of people still visiting the website, what amount converted.

Then, we broke it down by viewing two different channels: total traffic and organic traffic. Most companies are aware of slow industry months. The older the company is, the better they are at preparing for these slow periods.

Factoring in what our client’s ordered for that month, combined with how their organic traffic fared in comparison, gives us a much cleaner signal to see what was most effective while the rest of the industry slowed down.

What is Considered a Success in This Study?

It’s pretty easy to find success here. If the industry experienced a loss and we didn’t, we succeeded.

Can you predict when your slow months are?

Of course, you can! The older your available data, the easier it is. You can also take a look at tools like Google Trends for the top keywords for the industry to identify possible slow periods.

Another way to identify slow periods for larger companies is to find your competitors who have public stock on the market. Niche investors tend to have a good idea when the industry is likely to slow down or speed up, and you can use their same data to get a read on when that might happen to you, even if you’re a relatively new company.

You can also use Python, a coding language, to predict your performance based on previous results. This tactic can serve as a potential growth model. Often, this structure develops with the expectation that your marketing budget is going to grow along with your company growth. The more your budget fluctuates, the less accurate this method will be.

What can you gain from knowing it ahead of time?

When planning your marketing strategy, nothing should be rushed. The larger your company, the slower and more difficult it will be able to course-correct a flawed strategy.

Once you can recognize when you’re likely to slow down, you can alter your strategy to mitigate it.

The best use for this data, however, is an indicator of market research.

The real question is, why is the industry slowing down in the first place? Is it consumer-driven, supply-driven, or something else entirely?

There could be a significant shift in the ‘pain points’ your target market has that your products don’t address, or the industry hasn’t picked up on yet. Learning what causes this drop goes beyond useful marketing data– it can give you an edge over the competition in service and delivery.

Can you determine a growth cycle in a growing business?

Repeating this case study on your own business or clients can give you a much better idea on how to prevent a slow period in your growth, but combining that with your current growth cycle could turbo-charge your month-over-month returns.

Unfortunately, this case study isn’t a silver bullet. Finding your growth cycle is usually determined by a lot more than just the industry’s slow periods. Still, its also determined by when you adjust your marketing budget, your supply life-cycle, and the marketing life-cycle of your direct competitors.

Are there any leading indicators we can use to find these out?

Your veteran employees and Chief Officers are likely to know the answer to these questions already. Their voice should be your first clue when finding out what’s causing that slow period. It’s also a good indicator of where in your company it’s slowing down.

If Operations has a slow period in December, but none of your other departments are dealing with the same thing, you may have already stumbled onto a piece of the puzzle.

When are your industry expos? These are a fantastic indicator of when your industry is likely to experience a slow month. Some industries, like gaming, use these expos as ad platforms when they need the most significant boost. Meanwhile, other B2B industries use them for networking to prepare for the hyper-competitive busy season.

As mentioned above, take a look at where you match up to the industry average. Do you have a slow month the rest of the industry doesn’t? If you don’t experience your slow months when everyone else in your niche does, how are you beating them? Can you apply it to your off-season slowdown?

Slow Season Strategies

We didn’t just build this case study to check our past performance; we did it to see what was the most effective solution for dealing with slow seasons, and why they worked. If you want to see the most effective treatments for your cold sales month, learn how marketing automation, when to focus PPC or CRO, and how to maximize your social media leads.